“Program A” is Sprout Capital Management, LLC’s flagship investment program. Program A makes use of the best academic and practitioner research for managing risk and targeting high returns relative to the risk taken.

If you have an existing brokerage account (such as an IRA or a taxable brokerage account) or a 401(k) with a self-directed brokerage account option (SDBA), Program A may help improve your portfolio return and reduce your downside risk. The below results are for an aggressive investor, but the risk level can be adjusted to suit your particular circumstances. (Please contact us to find out how!)

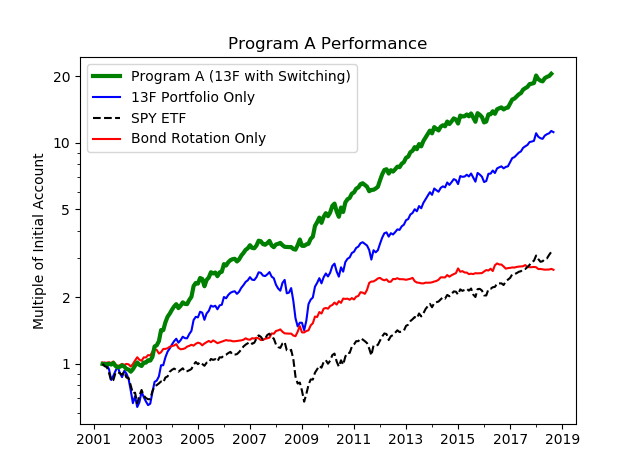

Figure 1. Comparing the performance of Program A with its components and the SPY ETF.

The results are hypothetical results and NOT an indicator of future results and do NOT represent returns that any investor actually attained. “Program A”, “13F Portfolio Only”, and “Bond Rotation Only” all reflect Sprout Capital’s management fee of 1%. Results are net of fund expenses and reflect re-invested dividends or distributions, but do not reflect other commissions, fees or taxes.

- Robust and Intuitive

- Invests alongside some of the best investors

- Uses market timing, but sparingly

- Efficient

- Low turnover for an active strategy

- Systematic

- Rules-based allocation

- Backtested = verifiable results

- Liquid

- Individual stocks and exchange-traded funds (ETFs)

We believe that the best investors in the world are no longer mutual fund managers or Warren Buffett, but hedge fund managers who specialize in holding publicly-traded stocks. These hedge fund investors have demanding clientele, large research budgets, a deep appreciation of risk management, and few restrictive mandates (compared to mutual funds).

Sprout Capital clients — who use Program A — invest in individual stocks which are held by certain hedge funds. These hedge funds have to report their stock holdings to the SEC via a 13F report on a quarterly basis. Investing in the same stocks reported to the SEC is called “13F tracking”. According to our research, this 13F tracking approach has been shown to produce outstanding returns when used with the right hedge funds! Program A only tracks and invests alongside those hedge funds that have low turnover and a long term (10+ years) track record of outperformance via their tracked portfolios.

When the economy enters a recession, the stock market generally experiences steeper-than-normal declines. Stocks held by hedge funds and Program A are not immune to these declines. Instead of staying the course, Program A clients will “switch” (i.e., sell) out of stocks and buy fixed-income exchange-traded funds (ETFs). This tries to keep client losses from becoming too severe.

The “switching signal” is completely systematic, and is based on long-term economic and stock market indicators. Signals occur infrequently — a few times per decade. The indicators that comprise the signal track different aspects of the economy that tend to lead, or are coincident with, stock market declines. Such indicators include excessive financial leverage, rising unemployment and slowing demand for housing. When the economy does show signs of a recession, the stock market must also be trending downward for the switching signal to indicate a “risk-off” stance. This confirmatory approach makes the strategy less likely to react to false signals.

While the switching signal is in a risk-off mode, Program A clients rotate monthly into the strongest fixed-income ETFs (measured by price momentum) from a group of different bond classes and gold. This systematic rotation aims to provide improved returns, as well as downside protection, compared to a buy-and-hold portfolio. Theoretically, this tactical approach should adapt to a variety of market conditions. For example, if the market environment is inflationary, as indicated by the strong performance of US Treasury-inflation protected security (TIPS) ETFs, Program A will rotate into a TIPS ETF. Likewise, in a deflation scenario, Program A will rotate into a long-term Treasury ETF, if it has strong momentum.

As shown in Figure 1 and Table 1, Program A produced a 17.6% cumulative annualized return since 2001. As a point of comparison, the S&P 500 ETF (SPY), produced a 6.5% cumulative annualized return over the same time frame. Sprout Capital Management, LLC may help increase your returns.

A steep loss, also known as a drawdown, can be disruptive if you react to the loss by selling in panic. We believe you are more likely to continue using a strategy if you know how it has performed in a backtest. Since 2001, Program A experienced a 18.0% maximum drawdown. By comparison, SPY experienced a 55.2% maximum drawdown from peak to valley on a daily basis. Sprout Capital Management, LLC may help lower your risk.

| Program A | 13F Portfolio Only | Bond Rotation Only | SPY ETF | |

|---|---|---|---|---|

| Annualized Return (AR) | 17.6% | 16.8% | 7.9% | 6.5% |

| Maximum Drawdown (DD) | 18.0% | 52.0% | 8.7% | 55.2% |

| Ratio AR/DD | 1.0 | 0.3 | 0.9 | 0.1 |

| Timeframe | 2001-2018 | 2001-2018 | 2001-2018 | 2001-2018 |

Table 1. Comparing the performance of Program A with its components and the SPY ETF.

The results are hypothetical results and NOT an indicator of future results and do NOT represent returns that any investor actually attained. “Program A”, “13F Portfolio Only”, and “Bond Rotation Only” all reflect Sprout Capital’s management fee of 1%. Results are net of fund expenses and reflect re-invested dividends or distributions, but do not reflect other commissions, fees or taxes.

Of course, you may not be an aggressive investor. Not every one has the same risk tolerance, goals, financial capacity or perception of the market. Sprout Capital Management, LLC can tailor its strategies for your situation.

If you need help deciding how to manage your employer retirement plan or your IRAs and taxable accounts, please contact us to start a discussion!