“Program B” is Sprout Capital Management, LLC’s preservation and growth investment program. Program B aims to provide moderate returns with bond-like risk using a bond ETF rotation strategy.

If you have an existing brokerage account (such as an IRA or a taxable brokerage account) or a 401(k) with a self-directed brokerage account option (SDBA), Program B may help improve your portfolio return and reduce your downside risk. Program B can be adjusted to suit your particular circumstances. (Please contact us to find out how!)

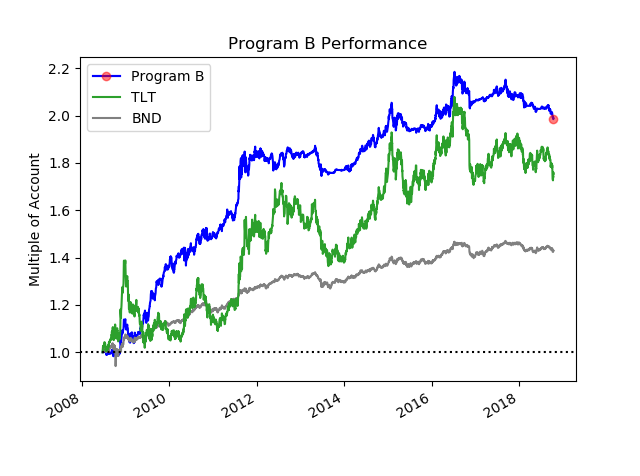

Figure 1. Comparing the performance of Program B with an ETF proxy for the aggregate bond market, BND, and an ETF proxy for US Treasury bonds, TLT.

The results are hypothetical results and NOT an indicator of future results and do NOT represent returns that any investor actually attained. “Program B” reflects Sprout Capital’s management fee of 1%. Results are net of fund expenses and reflect re-invested dividends or distributions, but do not reflect other commissions, fees or taxes.

- Robust and intuitive

- Invests in highest momentum bond classes

- Underlying theory is not complicated

- Complements Program A

- Program B is “risk-off” component of Program A

- Program B is also valid as independent strategy

- Portfolio combining Programs A and B can lower the risk relative to Program A alone

- Systematic

- Rules-based allocation

- Backtested = verifiable results

- Liquid

- Exchange-traded funds (ETFs)

It is not always appropriate to stay fully invested in the stock market. In such cases, Program B provides a strategy for investing in lower-risk investments. Program B rotates monthly into the strongest ETFs (measured by price momentum) from a range of different bond classes and gold. This systematic rotation aims to provide improved returns, for the risk taken, relative to a buy-and-hold bond portfolio. Theoretically, this tactical approach should adapt to a variety of market conditions. For example, if the market environment is inflationary, as indicated by the strong performance of US Treasury-inflation protected security (TIPS) ETFs, Program B will rotate into a TIPS ETF. Likewise, in a deflation scenario, Program B will rotate into a long-term Treasury ETF, if it has strong momentum.

Clients of Sprout Capital might use Program B in two different ways:

-

As a risk-off complement to Program A. When the switching signal from Program A is in a risk-off mode, Program A clients will completely reallocate their portfolio into Program B. Program B performance tends to be strongest when the stock market is weakest.

As an independent, fixed percentage of a portfolio. The overall risk of a stock portfolio can be reduced and balanced with Program B. Fixed income and gold investments perform differently and at different times relative to the stock market.

As shown in Figure 1 and Table 1, Program B produced a 6.7% cumulative annualized return since 2008. As a point of comparison, the BND ETF, a proxy for the aggregate US bond market, produced a 3.5% cumulative annualized return over the same timeframe. Also, the TLT ETF, a proxy for the long-term US Treasury market, produced a 5.5% return. Sprout Capital Management, LLC may help increase your returns.

A steep loss, also known as a drawdown, can be disruptive if you react to the loss by selling in panic. We believe you are more likely to continue using a strategy if you know how it has performed in a backtest. Since 2008, Program B experienced a 9.1% maximum drawdown. By comparison, BND experienced a 9.3% maximum drawdown from peak to valley on a daily basis. Similarly, TLT experienced a 26.6% drawdown over the same timeframe. Sprout Capital Management, LLC may help lower your risk.

| Program B | BND ETF | TLT ETF | |

|---|---|---|---|

| Annualized Return (AR) | 6.7% | 3.5% | 5.5% |

| Maximum Drawdown (DD) | 9.1% | 9.3% | 26.6% |

| Ratio AR/DD | 0.7 | 0.4 | 0.2 |

| Timeframe | 2008-2018 | 2008-2018 | 2008-2018 |

Table 1. Comparing the performance of Program B with an ETF proxy for the aggregate bond market, BND, and an ETF proxy for US Treasury bonds, TLT.

The results are hypothetical results and NOT an indicator of future results and do NOT represent returns that any investor actually attained. “Program B” reflects Sprout Capital’s management fee of 1%. Results are net of fund expenses and reflect re-invested dividends or distributions, but do not reflect other commissions, fees or taxes.

Not every one has the same risk tolerance, goals, financial capacity or perception of the market. Sprout Capital Management, LLC can tailor its strategies for your situation.

If you need help deciding how to manage your employer retirement plan or your IRAs and taxable accounts, please contact us to start a discussion!